News CNUE, 28 April 2022

Anti-money laundering: the importance of the economic method

–

3 questions for Antonio Cappiello. Expert on law & economics at the Consiglio Nazionale del Notariato

by Giampaolo Marcoz, president of the CNUE

During the last EU training seminars on anti-money laundering (e.g. Europe for Notaries, European Notarial Network, LIGHT), A. Cappiello (economic expert of the Italian notariat) captured the attention for a different type of approach, illustrating the importance of data analysis as a key element of the AML and using the macroeconomic evaluation to highlight the socio-economic contribution of notaries in the dialogue with policymakers. I asked Cappiello 3 questions in order to summarize, through his answers, some results of his analyses and to highlight how, in recent years, the economic approach has been effectively used by the CNUE and CNN in responding to the needs of international organizations that propose parametric tools as a guideline for the legislator.

M: How to measure the compliance with FATF standards and what does the aggregate analysis on CNUE countries tell us?

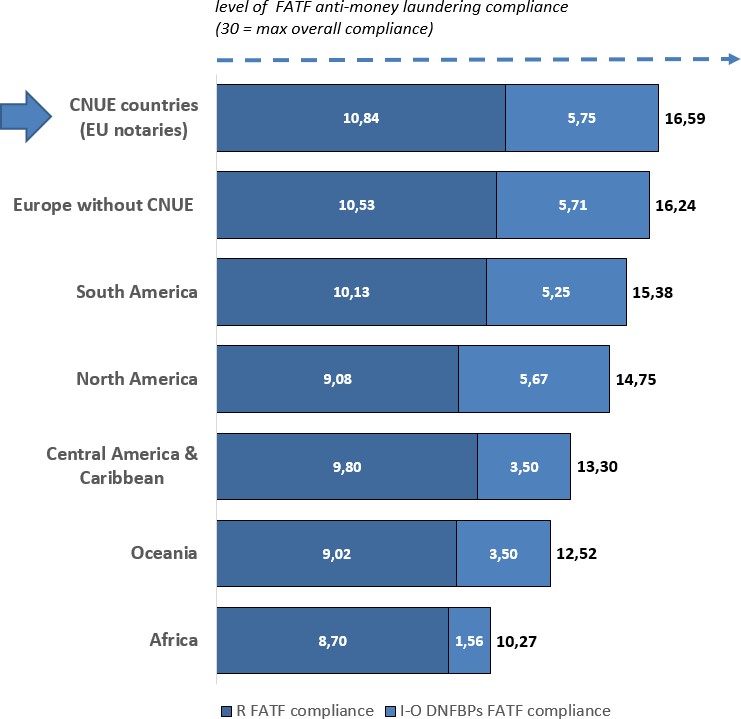

C: The recommendations of the Financial Action Task Force (FATF) are global AML standards, shared internationally, and allow various countries to work successfully against the illegal use of their financial systems. We can then use the FATF Assessment Reports (MER) to carry out further analysis and compare the level of compliance with the AML standards of different countries. Considering a sample of around 90 countries (based on the latest available FATF MER assessment reports), we can calculate the level of compliance by country cluster (countries grouped by area). Higher scores represent a better level of cluster compliance (see Fig. 1). In CNUE countries, most of the suspicious transaction reports (STR) of professionals are provided by notaries. Therefore we can use, with some elaborations, the FATF DNFBPs indicators as a proxy of the notarial contribution to AML policies (for example in Italy, according to the latest reports of the FIU, about 90% of the STRs come from notaries). The aggregate analysis of the data shows the best compliance in the field of AML by the CNUE countries.

Fig. 1 Better compliance with FATF standards by CNUE countries

M: Can “EU anti-money laundering notarial training and cooperation” have a multiplier effect?

C: The benefit of notary functions, if transformed into understandable synthetic indicators, can certainly help policymakers in the implementation of socio-economic policies. The “Europe for Notaries” seminars were also an opportunity for an exchange of good practices.. I believe that the seminars of the LIGHT AML Project and of the RNE can also provide the same opportunity. For example, on the occasion of the cycle of seminars of the European Notarial Network, we realized that the Latvian FIU data on STR indicated that a mandatory notary control on real estate contracts could have allowed better monitoring of the AML by the supervisory authorities. The data from the Latvian FIU only needed to be processed and interpreted: the data on notarial STR were an indication of the AML high potential of the Latvian notaries with whom we subsequently produced a study that was successfully used to support their professional policies with national authorities.

M: Why is it important to use the economic analysis?

Legislative choices, especially European legislation, are increasingly based on specific impact assessments and the use of cost-benefit analysis. Since we are convinced that the legal certainty provided by Notaries of Europe is an important value, it is necessary to highlight this important characteristic of the notary profession and provide evidence of it also through the typical tools of the economic analysis. The results that emerge from parametric studies represent important elements for communicating effectively with the legislator and stakeholders. Last November notaries, producing a macroeconomic study on the analysis of World Bank data, were the only professional body to be admitted to the OECD PMR workshop; thus being able to defend the interests of the entire category at an international level (link to the study). This is a different approach that integrates the traditional legal analysis. It requires time to test various methodological tools but it is necessary to adequately respond to international organizations that propose parametric tools as guidelines for policymakers.

In thanking A. Cappiello for his valuable contribution, I take this opportunity to remind that – starting from the results of the study on the OECD PMR indicator – CNUE will produce a more in depth macroeconomic study. In fact, given the growing need to relate to the indicators proposed by the main international organizations and considering the globalization of the professional services, socio-economic analyses that can highlight the efficiency and good economic performance of notary services at European level are of paramount importance.